Every crypto trader knows that Asia has a big influence on the global crypto markets. But increasingly, it’s not just buyers that are coming from Asia. New blockchain projects are springing up all the time, and one of China’s most established blockchain projects is NEO.

NEO 101

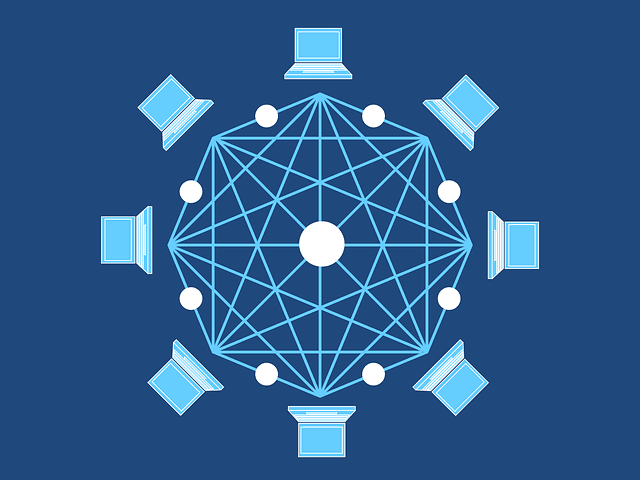

NEO is a blockchain platform that allows for the execution of trustless smart contracts. That means that, like Ethereum, it can be used for financial transactions, but it also can serve as a platform for more complex interactions and fully-featured distributed apps (dApps). It’s been called China’s “Ethereum killer” because of its similar functionality, and you might also occasionally see it referred to as Antshares – that’s what it was called prior to a 2017 summer rebrand.

Although it shares the same basic functionality as Ethereum, there are a few key differences between the two projects.

First, while Ethereum requires developers to code in its own programming language (Solidity), programmers who’d like to write a dApp for NEO’s network can do so in a variety of languages they may already know, including C#, VB.Net, F#, Java, Python, Ruby, and Kotlin. That makes getting started with a NEO project much easier for first-time blockchain developers coming from other platforms.

Second, instead of using a power-hungry proof-of-work consensus algorithm like Bitcoin or Ethereum, NEO uses a proof-of-stake system with delegated Byzantine Fault Tolerance (dBFT). What that means – to vastly oversimplify – is that consensus is achieved when 66% or more of the nodes on the NEO network confirm a transaction.

This keeps the network secure, because voting power is determined by a user’s stake (how much of the NEO token they own). A malicious actor would need to buy most of the world’s supply of NEO in order to have the voting power to insert fraudulent information into the network successfully.

Third, the NEO network actually includes two tokens. There’s NEO, which is the main token on the network and the token used to determine a user’s stake (and therefore voting rights). But holding NEO in an officially-approved wallet automatically generates a second crypto token called GAS that’s used for transactions on the NEO network.

It’s a bit like a stock dividend: the more NEO you own, the more GAS you can collect, and while GAS was designed to be used as a form of payment on the NEO network, it’s also traded in several crypto markets.

Proof of Identity

Being a China-based project, the developers of NEO knew that China’s government is unlike to smile upon any technology that allows people to exchange money across borders anonymously. So NEO includes digital identity verification features based on the X.509 standard. Smart contract creators can even choose to make use of biometrics like facial scans, fingerprint scans, and voice scans as well as two-factor confirmations like SMS verification to ensure that users are who they say they are.

These systems are not mandatory. In fact, it’s possible to buy and hold NEO without providing any personal information whatsoever beyond whatever the exchange or person you purchased from requires. But the ability to access Know-Your-Customer features and adds a level of security to the network for dApp developers who want it, and helps insulate NEO somewhat against the threat of regulation.

Special Characteristics of the NEO Tokens

The NEO token itself has some unique features. Unlike most tokens, it’s not divisible, meaning that you can’t own 1.5 NEO or 3.8453 NEO, you can only hold NEO in whole numbers. Many cryptocurrency exchanges allow you to purchase NEO in fractions, but the currency can only be transferred to wallets (or counted for network stake and voting rights) in whole numbers.

Transferring NEO is free; although some exchanges add their own transaction fees, a private-wallet-to-private-wallet transaction costs nothing.

There are 100 million NEO tokens in existence, although the current circulating supply is only 65 million, with the rest being held in reserve by the NEO team for various purposes.

Unlike NEO, GAS, the token that actually pays for transactions on the NEO network, is divisible into decimals. There is also a hard cap of 100 million GAS tokens, although these tokens are generated over time as users stake their NEO, so the current circulating supply is quite a bit lower.

The NEO Ecosystem

A smart contracts platform is only as strong as its ecosystem, and NEO’s programmer-friendly approach to dApp development has meant that this relatively new blockchain is already host to quite a few promising projects and ICOs. Some of NEO’s already-funded projects include:

- Red Pulse (RPX) – a market intelligence platform for investors interested in the Chinese market.

- DeepBrain (DBC) – a decentralized AI platform for for smart software applications and gadgets.

- TheKey (TKY) – decentralized identity verification tools for KYC and general identity verification.

Upcoming ICOs on the NEO platform include everything from a decentralized crypto exchange to an open-source medical encyclopedia.

NEO and China

NEO is a China-based project that’s being developed by a company called OnChain. The project is headed up by Da Hongfei, and the OnChain team has worked with a number of high-profile tech firms including Alibaba and Microsoft. The NEO project specifically has also worked with Microsoft China on some joint events.

NEO being located in China has led to a lot of misconceptions and misinformation as Western investors unfamiliar with the market struggle to interpret information they come across. To clear up a couple of common misconceptions:

- NEO is not officially endorsed by the Chinese government, nor is it immune to regulatory risk in China. Its identity verification features do make it less likely to face a wholesale ban than anonymity-focused coins like Monero, but it could still be targeted. NEO developers have been invited to government-sponsored blockchain conferences in the past, but this should not be understood as official government endorsement or approval of NEO.

- OnChain’s work with Alibaba was for a separate project and not related to NEO. Despite the similarity between the names of Ant Financial (Alibaba’s payments arm) and Antshares (NEO’s old name) there is no connection between the two companies.

That said, China has historically acted to regulate technology in a way that benefits domestic companies at the expense of foreign rivals. The banning of Twitter and Facebook, for instance, helped domestic alternatives Weibo and Renren to rise, and heavy import duties on foreign-designed phones have helped bolster China’s domestic smartphone makers.

If the country takes a similar approach to crypto regulation, NEO is the country’s most established domestic blockchain project and thus would be in prime position to benefit.

Investor Alert

As is typically of successful cryptocurrency tokens, the rise of NEO has attracted scammers and fraudulent projects looking to hijack NEO’s brand recognition to trick investors.

Beware of “NEO Gold” and “NEO Cash”, they are ERC20 tokens that run on the Ethereum network and have no affiliation with NEO.

Beware also of NEOConnect which, like BitConnect and ETHConnect, is a pyramid scheme and has no affiliation with NEO.

NEO’s Future

Having established itself as China’s leading smart contracts platform, NEO’s future looks bright. The token has already seen massive growth over the past year, but with fewer circulating coins than Ethereum and a far lower market price, the sky’s the limit for NEO if it really proves to be the “Ethereum killer” it’s sometimes billed as, or even just manages to stake out a claim to a significant share of the world’s smart contracts market.