We’re all here because we think cryptocurrency is cool, but let’s be honest: as an actual currency, it’s often terrible. Most vendors simply won’t accept it; even if they might want to, they generally don’t have the infrastructure. That means that to turn your crypto into useful currency, you’ve often got to:

- Send it from your wallet to an exchange

- Wait for that transaction to process, which could take anywhere from seconds to hours depending on the crypto you’re using

- Sell it on the exchange for fiat currency

- Withdraw the fiat currency from your account to your bank account

- Wait for that transaction to process, which often takes days

The whole process is a bit clunky, to put it mildly.

So here’s an alternative: what if you could spend crypto just by swiping a card? That’s the idea behind TokenCard.

TokenCard 101

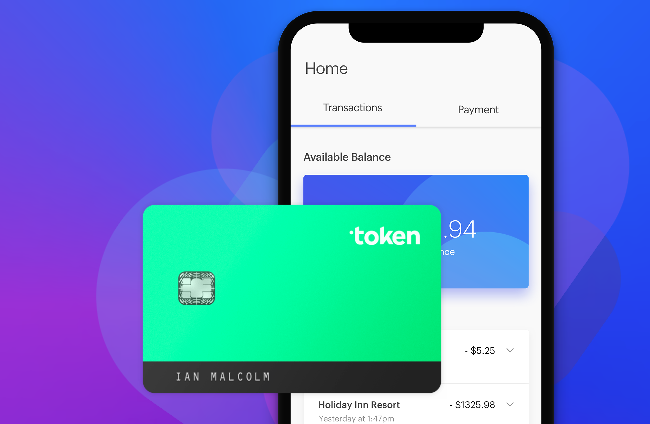

Basically, TokenCard is a swipe-able debit-style card that you can use in locations all over the world (including ATMs) that’s funded via an “allowance” you designate based on the amount of ETH or TKN in your ERC20-compatible wallet.

For example, you could tell TokenCard how much of your ETH or TKN it’s allowed to spend, and it would let you swipe for up to that much in fiat based on the current value of your crypto. Or you could set your “allowance” as a percentage of your total holdings, or in terms of fiat, or even by time period.

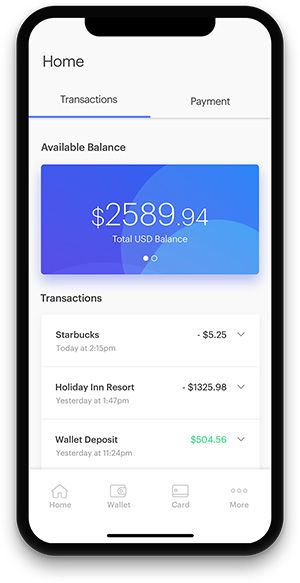

It will come with a companion wallet app that makes it easy to manage all of your ERC20 tokens as well as manage your TokenCard account settings and allowance rules (which you’ll be able to change at any time). The app will also act as a kind of exchange, allowing token-to-token switches right from inside the app.

What is TKN?

You can use TokenCard with ETH (and it’ll ultimately support up to five of the following tokens once they’re chosen for inclusion by the community: REP, MKR, DGD, ICN, MLN, GNT, 1ST, and SNGLS). But TokenCard also works with its own proprietary token, which is called Token (TKN). Easy to remember, right?

TKN is an asset-backed ERC20 token. Each TKN represents a portion of the funds accrued through TokenCard’s 1% transaction fee. Every time a TokenCard is swiped, that 1% fee is sent to the TKN Asset smart contract, in the form of whatever token was used to make the purchase. Holding TKN, therefore, allows a user to hold a piece of a growing pool of ERC20 tokens as TokenCards are used all over the world.

But TKN holders can do more than hold. You can spend your TKN, which allows you to make purchases without being charged that 1% transaction fee. And at any time you can cash in your TKN for a proportional share of the assets held in the TKN Asset smart contract. When you cash in TKN, it’s “burned” – destroyed forever – thus decreasing the global supply of TKN and increasing the proportional value of every remaining TKN token.

You can also trade TKN speculatively on a variety of cryptocurrency exchanges as well.

Security

Security is obviously a primary concern for many crypto holders, and the TokenCard team think that’s an area where it can make a real impact. Because the user experience of creating your own wallet is generally terrible, most crypto holders keep their tokens with third-party providers, at the risk of ending up the victim of the next high-profile hack.

TokenCard aims to make the wallet creation process easy and fun via its mobile app, so users won’t be storing tokens in a giant third-party wallet that’s a big target for attacks. And it’ll also come with other security features, like the ability to freeze your card’s functionality, so that if you lose it and somebody else picks it up, they won’t be able to drain your account.

The Token Team

Building TokenCard is obviously an ambitious project, and one that has yet to be fully realized. But the TokenCard team, bolstered in part by last year’s TKN token sale, is scaling up. Having recently added a CTO with years of C-suite level tech experience, the company’s immediate priority, it says, is building a world-class engineering team and jumping through compliance and regulatory hoops.

But it’s clear the team is thinking things through. For example: according to its whitepaper, TokenCard will be available even in regulatory-heavy China at launch. That’s a major market, but it’s difficult enough to get a handle on that many blockchain projects don’t even bother trying. The fact that TokenCard is confidently taking it on is a good sign that the company is shooting for the stars.

The team has also already proven it’s ability to handle the inevitable bumps in the road that come with being a bleeding-edge tech startup. When its original card issuing partner WaveCrest kicked the bucket, TokenCard put its nose to the grindstone and found another one. The WaveCrest demise will likely prove to be a boon to TokenCard, as it has set back many of the first-mover crypto card issuers that are TokenCard’s competitors. The new partner – whose identity TokenCard has not announced yet – will also allow for day one NFC and contactless payments.

So when exactly is day one? That’s still a bit of a mystery. If you’re interested in using your crypto to pay with a card, this is an option you should be keeping an eye on.