I’m writing this article as Bitcoin just hit an all-time high of $7429 per coin. I should be happy, right? While it’s fun looking at a small fortune on my computer screen, I’m the type of guy who questions everything.

When one asset class goes up, what about everything else? It’s important to look at the entire economy as a whole in an effort to figure out the landscape ahead.

While Bitcoin, the S&P 500, the Dow 30, and Nasdaq have recently approached all-time highs, it’s time to take serious inventory of the state of our economy, your personal finance habits, and where we might be headed as a country if we don’t get our act together.

Disclaimer: I’m not a financial advisor, I’m not an accountant, I’m an entrepreneur. Take whatever I say for what you think it’s worth and apply as you see fit.

I’ve experienced struggles in my life, nothing has been handed to me. There are times where I’ve had less than $1000 to my name and I’ve had to stretch a budget by eating Marie Callender’s meals to survive, dark times I hope I never have to experience again.

Eight years ago I was making sandwiches at the Portly Villager for $10.00 per hour and know what it’s like to work hard to get by. I’m fortunate I believed in myself when others didn’t and positioned myself to thrive in a tough economy coming out of the last recession.

I’m still working as hard as I did in 2009 because I never want to be in a position where I’m not in control of my future or my finances. When people are fat, happy, and contempt, it’s time to start questioning what’s really happening and what will happen in the future.

Your Ability to Predict the Future Will Determine How Successful You Will Be

Look at anyone successful in the area of finance, they usually have a track record of making good decisions and being able to predict outcomes far before they happen.

Let’s look at professional athletes who are able to perform feats of greatness and leave spectators wondering if what they saw was real. How did they know where to be to receive the ball? How were they able to take advantage of a “chance” situation?

In both instances, the answer is simple: they saw it in their mind’s eye before it happened because they already knew the outcome.

If you can predict how people will react to something, coupled with how you will react when something happens, the more successful you will be.

Developing this sense of awareness through questioning everything and repeating this process over-and-over can take an average performer and turn them into an all-time great.

In 2018, our family will be paying $1,068/month for catastrophic health insurance. $14,000 out-of-pocket max. I wish they’d kick me out. 🇺🇸 pic.twitter.com/2qAe9FA8cS

— Andrew Culver (@andrewculver) November 1, 2017

Average People Have Average Thoughts & Financial Resources: Don’t Be Average

Health insurance is hot topic right now. With premiums climbing and becoming out of reach for most people it’s natural to wonder how people will be able to afford “catastrophic event” coverage which requires an out-of-pocket max totaling more money than the average person has in a bank account.

While I’m fortunate to be in a position where these premiums can be tolerated, what about everyone else? While we all know it’s a raw deal and premiums are absurd, will you stop paying them and go rogue? If you have dependants, I’d certainly hope not.

Much to your ability to predict the future, I’m already mentally seeing premiums north of $2000 for basic coverage where average people will struggle. Premiums will be paid until there is no feasible way to sustain and a decision will need to be made: food, the mortgage, or health insurance?

Average people rely on their government, President, and resources they’re not in control of to stay afloat. There is where some forward thinking to see the road ahead, prepare accordingly, take responsibility, and create a reality where monthly health insurance premiums won’t have any impact on your finances will be helpful.

Throw a middle finger to letting outside forces control you, don’t be average. Think bigger.

Companies Will Downsize & Payrolls Will Shrink: How Will You Survive When Winter Comes?

As a business owner, I’ve never understood how there can be taxes based on the wages paid to employees. It’s counterintuitive, as small-businesses especially are what’s keeping food on people’s tables and everyone’s bills paid. As it stands, payroll taxes do not incentivize a business owner to increase wages or invest in growing the business through acquiring more talent.

If we’re striving as a nation to bring jobs to the USA, business owners should receive a payroll credit which can be used to offset tax liabilities instead of a payroll tax which instantly siphons money from the business every time payroll is processed. In turn, that would incentivize potential hiring in the USA and improve morale for business owners.

The average employee has no idea how expensive they really are and most business owners are too stoic to share the truth about how much a single employee (on payroll with benefits) impacts the bottom-line with their team.

Practical Application: For my business, I’ve made challenging the norm work. For other industries this strategy may not work. I ditched the fancy office, ditched payroll, ditched paying health benefits to employees, and moved my company to a different state.

The end result helped my business generate 3.5 times the revenue we did in 2015 and create a tax bill larger than I’ve ever seen before, creating a win-win. Regardless of how much of a blood-sucking leech Uncle Sam is, my business still prevailed.

As it turns out, running a remote company where the entire team is comprised of Independent Contractors was more effective than the traditional approach of sourcing local talent where everyone shows up to an office at 9:00 AM and leaves at 5:00 PM.

Many blockchain-based tech companies are taking the same approach where traditional business norms are being challenged. Consider your options to control your future as you see fit, to gain a competitive advantage in the marketplace. Don’t get left behind.

Retirement Accounts Are For Suckers: Don’t Be a Sucker

With the exception of a self-direct IRA, retirement accounts are one of the worst places to store your hard earned cash to build wealth.

The max limits on a typical Roth IRA contribution are $5500 annually, which is painfully low for the average person to succeed and build wealth over the long-haul. Even if you’re maxing out contributions, the average person is inclined to blow the rest on a trip to Disneyland, an extra night at a Holiday Inn®, and a day of extravagance at Knott’s Berry Farm. While the continental breakfast might be a perk, you’re not coming out ahead.

Also, employer match 401k’s are usually raw deals if they’re not generous enough. The worst thing about those programs is they attract average talent, being satisfied with an average contribution match, and motivate employees to stay longer than they should creating a lose-lose scenario. What worked decades ago is becoming obsolete today.

Practical Application: Stop thinking about retirement and start thinking about creating wealth today where you’re in total control of your assets. Everyone is concerned about minimizing capital gains taxes, they’ve lost sight of the big picture. Don’t be that sucker.

The best financial move I made was liquidating my Roth IRA in 2011 totaling $8600 before I founded The Link Builders. I’ll never forget the meeting I had at the bank where they told me I was making a big mistake and I’d regret making the withdrawal when I had to pay the tax penalties down the road. While the tax penalty stung the following year, that $8600 was the fuel needed to launch a company which led to doing millions annually in sales.

The Expense of One Person is the Income of Another: How Our Economy Works

Relax, stop reading, and watch the video above. The next 30 minutes will be presented to you by Ray Dalio, one of the greatest investors of our time.

The video presented above sheds light on how our economy works better than any resource I’ve found and brings attention to many items and concepts I’ve noted above.

Mortgage Interest Rates are Too Low & FHA Loans Make Borrowing Too Easy

Last year, my wife and I closed on our primary residence utilizing a conventional mortgage with a fixed interest rate of 3.25% over a 30-year term. We didn’t have to put 20% down on the deal, but I wanted to park free cash in a different asset class.

In the past 18 months, interest rates have been at record lows and the utilization of FHA loans has increased enabling buyers to place 3.5% down on properties with loose lending requirements where real estate can be purchased with little skin in the game.

If interest rates on mortgages are at record lows, how profitable can these deals be relative to the risks? What’s concerning is insurance premiums, utilities, and property taxes are all increasing. Coupled with inflation, wages remaining stagnant, reduction of available credit, poor financial habits, the threat of employment loss in a changing economy, and more options to consume and spend money than ever before, disaster becomes imminent. Buckle up, prepare accordingly, and understand what may lie ahead.

Everyone is Rich, Happy, and Interesting on Instagram

Instagram didn’t exist during the last recession, which in hindsight is a good thing. Since the economy corrected, Instagram culture has impacted the way we view our friends, strangers, and our own self-worth in comparison.

Much of our behavior and how we perceive what’s “normal” is consumed through a screen in our pocket where you’re able to peer into the life of someone else anytime you want. While most realize this, what you’re viewing on Instagram isn’t reality.

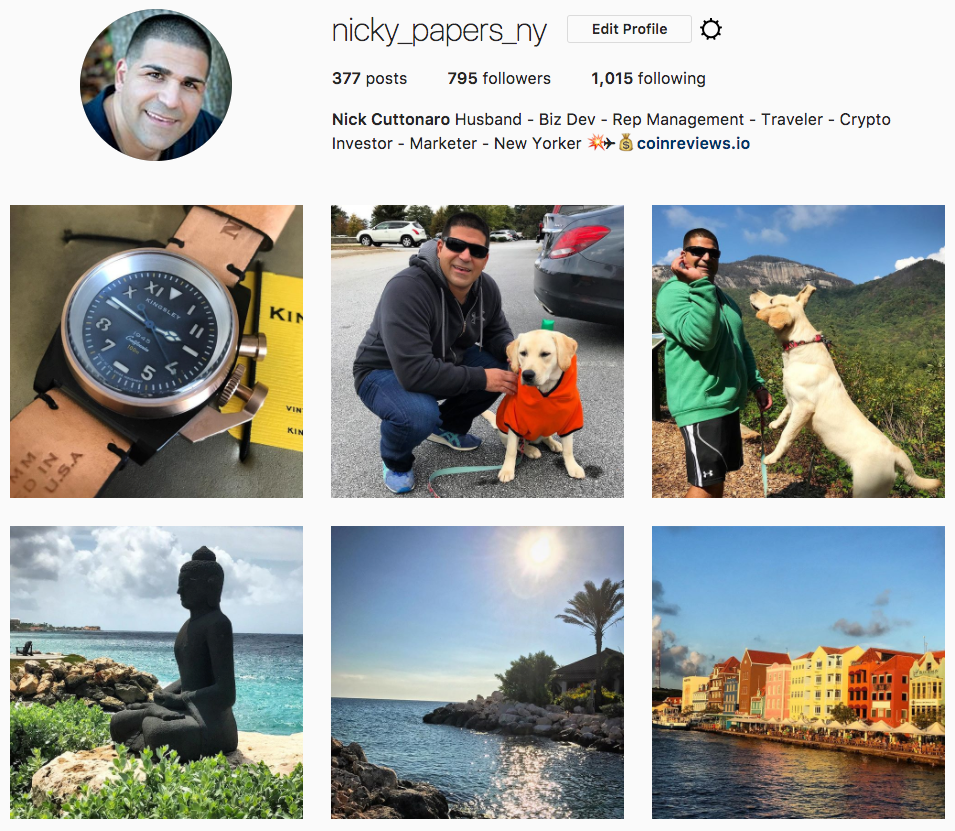

My Instagram account is a highlight reel of my life where you’re only seeing content showcasing fun, happy, interesting, amusing, and exciting moments I selectively share. The same likely holds true for anyone reading this who actively posts on Instagram.

It’s a paradox as we typically view the fun and exciting lives of other’s on Instagram while relaxing on the couch, laying in bed, or in some instances sitting on the toilet.

This repetitive and often compulsive behavior of constantly looking at everyone else on Instagram or seeing how many “friends” are acknowledging our lives through social media can have negative long-term effects on how we approach life and make decisions when there’s a need to “keep up” with everyone else. People care about you less than you think.

Real Talk: My life is a far cry from what you see on Instagram. Most days I’m at home in front of three computer monitors working for 12-14 hours, wearing basketball shorts and a t-shirt, with 2 week old half-drank Gatorade bottles surrounding me. It’s likely I could use a haircut, a shower, and a shave. Last, anyone who says they’re a “marketer” in their social media bio, it’s safe to assume you’re being marketed to. Buyer beware, as they say.

This could easily become a book, so I’ll stop it there. Sometimes it’s hard to see what’s actually going on when the perception of many is distorted by a false sense of financial security and how we perceive the world around us.

It’s exciting to see the price of Bitcoin continue to rise but what about everything else? What will you do when things get tough and the security you thought you had is no longer there? Hopefully, this article served as a wake-up call to take inventory of where you’re at relative to where we might be headed as an economy. Prepare now or perish later.