![]()

Having a stash of cryptocurrency is great for a lot of things, but it isn’t always particularly useful if you need money. Cashing out can be a complex process, and of course it can also ensure you miss out on future gains. SALT Lending is a blockchain lending platform that’s designed to help crypto-holders avoid the problem entirely by offering cash loans in return for your cryptocurrency collateral.

How Salt Lending Works

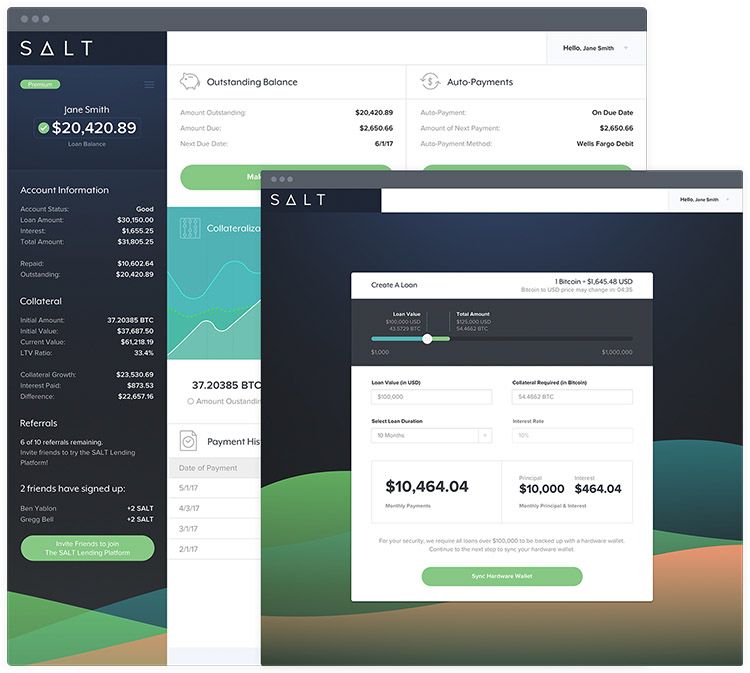

SALT stands for Secured Automated Lending Platform, and that’s exactly what it is. It use smart contracts to set and execute loan terms automatically, so that lenders and borrowers can both benefit, secure in the knowledge that they won’t lose their money as long as they fulfill the terms of the loan. The entire process is automated, and because the borrower’s cryptocurrency is used as collateral, there’s no need for a credit check.

A Sample SALT Loan

To understand SALT better, let’s look at a hypothetical example. Imagine you’ve got significant Bitcoin holdings, and you’d like to leverage those holdings to make a big purchase. Let’s say you want to buy a really nice crypto mining rig and some solar panels to power it.

You don’t have the cash for that kind of a purchase on hand, so how can you get it?

Getting a traditional loan for it would be difficult, particularly if your credit score is low (or if you don’t have much credit history). Most banks don’t understand or trust cryptocurrency, and they’re certainly not going to accept your Bitcoin as collateral for a loan, so you’re out of luck with traditional banks.

You could cash in your crypto holdings, but that can get complicated, it’ll incur fees and taxes, and it means that your coins won’t appreciate in value if the market goes up. If you’re still bullish on BTC, then cashing in your coins isn’t a very attractive option.

So instead, you go to SALT. After signing up as a member, you can browse the term offers of different lenders on the SALT platform to find a loan that’s to your liking. Once you’ve found it, you send your BTC collateral to SALT’s smart contract, and the lender’s funds are deposited into your bank account.

Next, it proceeds like a normal loan: you repay your lender over time via SALT platform. When you’ve paid the loan off completely, your Bitcoin is automatically returned to you and there are no prepayment fees if you decide to pay it off early to get your BTC back.

What if things don’t go as smoothly? If you miss a payment, SALT’s smart contract will automatically sell a small portion of your held-in-collateral Bitcoin to cover the payment and any associated fees. That’ll keep happening as long as you miss payments, but once the loan is fully paid you’ll get any leftover BTC from your collateral back, so even defaulting might not mean a total loss.

This system ensures that both lenders and borrowers can feel safe: borrowers know they’ll get all of their crypto back if they make payments on time and ultimately pay off the loan. Lenders know they’ll make their money back even if the borrower flakes and misses a few payments or defaults.

How Much Can I Borrow? Can I Also Be a Lender?

How much you can borrow on SALT’s platform depends on what tier of membership you purchase. A basic member can borrow up to $10,000, receive loans in USD, and select terms of between 3 and 24 months for repayment. But there are higher membership tiers for high-rollers and organizations that allow for access to loans of up to $1 million, as well as allowing for more flexible terms and additional payout fiat currencies.

Whether you can be a lender in addition to a borrower, the answer is: “probably not.” SALT isn’t a P2P lending platform, and to become a SALT lender you have to be an Accredited Investor or a financial organization, and you have to pass SALT’s screening process.

If you do fit the bill, though, you won’t need any crypto holdings to lend via SALT’s platform. Loans are issued and paid using fiat currency, although you can elect to receive crypto instead if you prefer.

Already Operational and Still Expanding

The example above was hypothetical, but unlike a lot of blockchain projects, SALT is already an entirely functional product. You could sign up on SALT’s site and take out a BTC-backed loan today – indeed, more than 50,000 people have already done that, and the platform has issued more than $7 million in BTC-backed loans.

And of course, that’s just the beginning. This year, the company plans to add support for ETH-backed loans, issue crypto-backed credit cards, and later in the year add support for altcoin loans beyond ETH and BTC.

The SALT Token

SALT’s smart contracts run on the Ethereum blockchain and the SALT lending network has its own ERC20 token: SALT. SALT platform memberships are purchased via SALT tokens, and at the moment SALT can also be used to pay down loans or buy better interest rates on the SALT platform. SALT tokens can also be used for purchases from SALT’s online shop, which currently offers only hardware wallets.

SALT tokens can be purchased directly from SALT on its platform at a preset price of $27.50 per SALT.

SALT tokens are also traded speculatively by investors, of course, and are available on major exchanges including Bittrex, Binance, and Huobi, and the price on exchanges differs from the price charged by SALT itself. As of this writing, SALT is cheaper on exchanges than it is on SALT’s platform, but SALT tokens purchased directly from SALT are refundable whereas exchange-bought tokens are not. (You can buy tokens on an exchange and then transfer them for use on SALT’s lending platform, though).

Challenges & Considerations

SALT’s biggest challenge in the years ahead may be competition. Although it’s an early mover in the crypt-collateralized loan space, it’s far from the only player. Competitors like Coinloan, Ethlend, Elix, and BTCPop are popping up left and right to serve the crypto space with loans, although their specific business models vary and SALT is further into its roadmap than most of them.

Long-term, there’s also the risk that as big banks and the mainstream embrace cryptocurrency, they could start moving in on SALT’s territory, too.

The good news is that SALT has a solid head start and it’s backed by a strong team including a CEO with extensive management experience and advisor Erik Voorhees, who’s also the founder and CEO of ShapeShift. If you believe crypto-backed loans are going to be a big thing, SALT is definitely worth a closer look.